The weekend turned brutal for the entire cryptocurrency market which posted a global crypto market cap of $3.42 trillion, crashing down a staggering 5.37% in the last 24 hours. As the market crashed today, Bitcoin (BTC) fell sharply, dragging major altcoins along with it including Ethereum (ETH), Solana (SOL), XRP, and even some popular memecoins. The crash has left investors alarmed and searching for explanations.

Why is Crypto Crashing Today?

The big crash this weekend is mostly due to several factors shaking up the global markets. The crypto lucre is looking somewhat endangered as a stock market selloff, partly driven by growing hype around the China-based artificial intelligence app DeepSeek, which seems to have leaked into the crypto economy as well.

One of the biggest crypto traders Arthur Hayes has also warned that a financial crisis lies ahead which might prompt the Federal Reserve to come up with new stimulus measures. The cryptonomy instability is being worsened by this uncertainty in the overall market.

Bitcoin’s descent below $100K

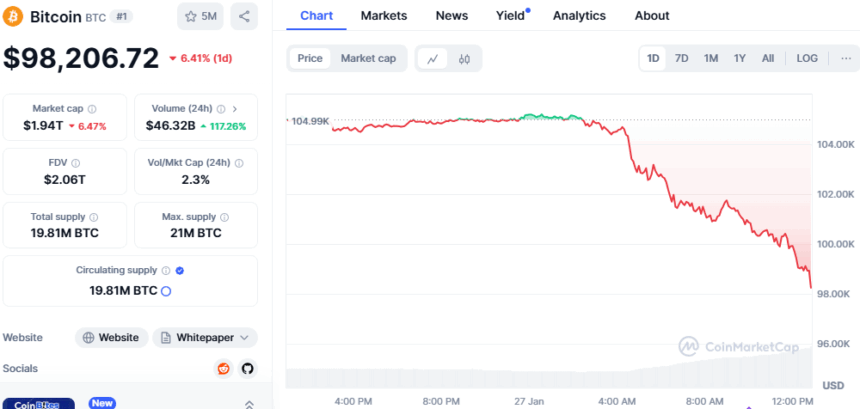

Bitcoin, the gold standard of crypto, also tumbled below the $100,000 mark, closing at $98,206.72, marking a 6.41% drop in the last 24 hours. This represents a sharp decline from its recent peaks, including the high-water mark of $110,000 it hit just before President Trump’s inauguration.

Bitcoin’s all-time high market cap stood at $1.94 trillion, backed by a $46.22 billion trading volume in the last 24 hours when the Bitcoin dip captured anticipation toward its stability.

Altcoins feeling the heat

Ethereum (ETH)

The second-largest cryptocurrency, Ethereum, lost value with a 6.84% drop, trading at $3,113.86. The token price sees a 32% pumping at $375.25 billion in market cap and $22.02 billion in trading volume.

Solana (SOL)

Solana fell harder still, dropping 11.42% to $228.87, for a market cap of $111.36 billion, and the trading volume, valued at $6.17 billion, surging 50.31%.

XRP (XRP)

XRP, a darling of many retail investors, was down 7.30% to $2.90 and had $6.09 billion in trading over the past day. Such losses have left investors cautious of the downside at the altcoin level.

Memecoins take a beating

But while altcoins have struggled, memecoins, those notoriously volatile coins, have fared even worse with severe double-digit losses all around:

Official Trump (TRUMP): This memecoin fell 16.09% to $26.07. With a $5.21 billion market cap and a hefty $3.41 billion in trading volume, the coin’s decline mirrors a broad sell-off in speculative assets.

Official Melania Meme (MELANIA): MELANIA dropped 8.72%, and is now at $2.41. Its $416.87 million market cap and $107.59 million trading volume indicate investors are cautiously proceeding.

MAGA (MAGAMemecoin): Then again, MAGA showed the biggest drop, plummeting 44.16% down to $3.00. Its market cap currently stands at $132.17 million, while its trading volume is a comparatively modest $3.85 million at the same time.

Fartcoin (FARTCOIN): Popularizing its branding with its comedic origins, it fell 24.66% to $0.9685. The fall of the coin, which has a market cap of $968.49 million and trades with a volume of $306.38 million, underscores the dangers of speculative bets.

Pepe (PEPE): The popular meme-based token was down 15.40% to $0.00001268. The market cap is $5.33 billion, and trading volume in the last 24 hours has been $924.37 million.

FLOKI (FLOKI): FLOKI was not spared as well and slipped 11% to $0.0001226. It boasts a market cap of $1.17 billion and a $190.74 million trading volume, showing that its investor base remains extensive despite the losses.

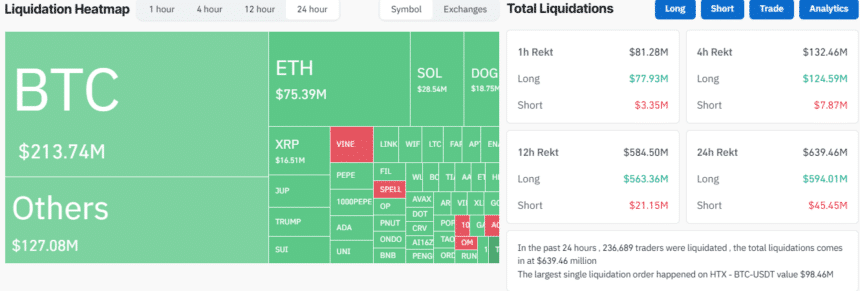

Widespread Liquidation

The market crash led to mass liquidations, with $667.57 million liquidated in 24 hours. Long positions were the hardest hit, being liquidated to the tune of $622 million, compared to $45.57 million for shorts. More than 247,000 traders were liquidated, with the largest single liquidation being $98.46 million in the BTC-USDT pair on HTX.

The collapse in crypto this weekend serves to highlight the volatility and risk of digital assets. With Bitcoin finding it hard to push up above $100K and altcoins and memecoins licking their wounds, the rest of the market appears to be in a holding pattern for clearer signals from the Federal Reserve, the global economy, or regulatory firmness. The question for now is: How much worse can it get before a recovery starts?

Also Read: $7.8 Billion in Bitcoin Options Set to Expire by Month End