Ethereum (ETH) took a beatdown today, dropping 8% to $2991 before retracing back a bit to now trading at $3017, leaving many traders to wonder if there’s any chance for recovery.

This dip started last week Friday after the unexpected U.S. interest rate data brought fears that inflation could rise and the Federal Reserve might not cut interest rates as quickly as expected.

At the same time, the U.S. job market also came in with an additional 256,000 jobs, far surpassing the expected 160,000. This in short meant the economy is healthy. However, this pushed the U.S. bond yield higher and therefore puts pressure on risk investment from cryptocurrencies.

The rise in yields, especially the U.S. 10-year bond, is weighing heavily on markets, including Ethereum. Shortly after the data release, ETH dropped from $3332 to $3196 and has been dropping gradually since then.

ETH has emerged as a ‘cursed coin’ among traders because even though open interest has been up by 110% since August last year, its price is still more than 20% lower than its ATH.

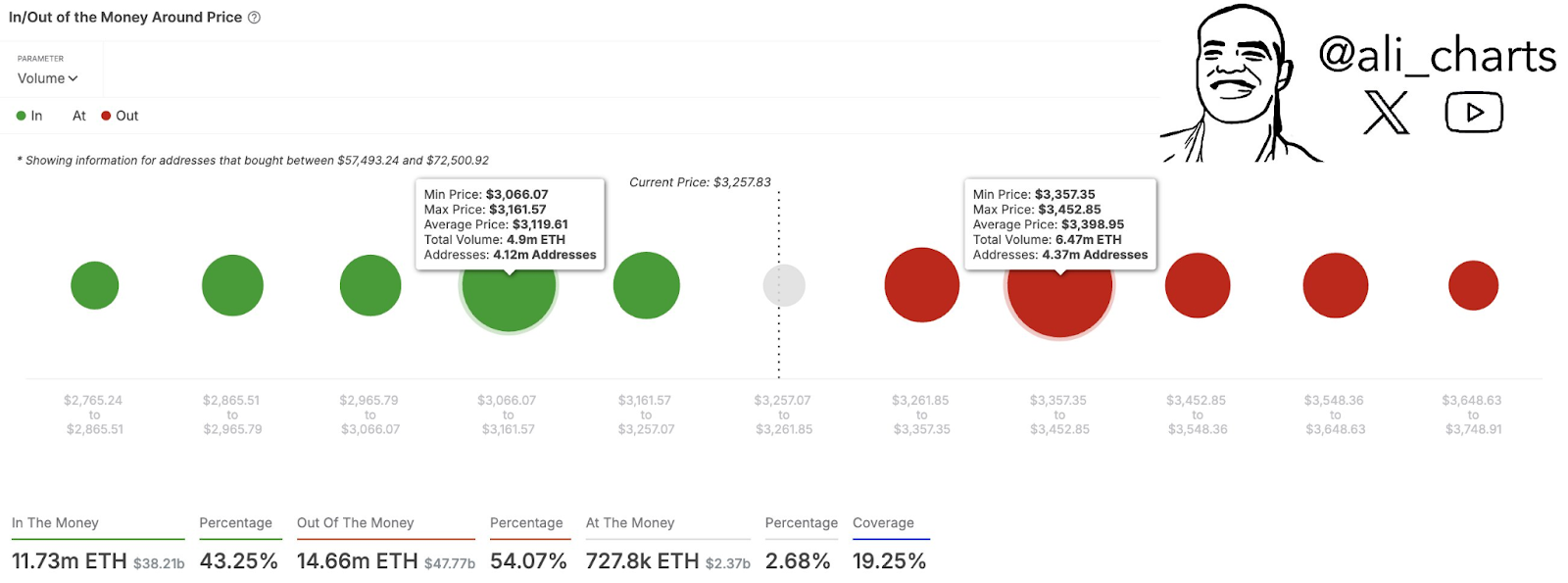

Chart analyst Ali Martinez, in a recent tweet, said there are resistance levels between $3,360 and $3,450, with key support levels also at $3,066 and $3,160. He also showed that three whale wallets control 43% of Ethereum’s total supply, which could affect its price movements.

Benjian Cowen, the CEO of IntoTheCryptoverse, also clarified that Ethereum’s supply will soon go back to pre-merge levels due to a monthly increase of 45,000 ETH. Currently, Ethereum’s supply is just 32,000 ETH below its pre-merge level. Meanwhile, data from Lookonchain shows that the whales continue to accumulate ETH. As recently, a whale withdrew 10,000 ETH worth around $30.76 million from Binance.

Data from IntoTheBlock showed that large transactions increased by 70.2%, but transactions over $100,000 went down a bit. Netflows in exchanges also jumped by 791.5%, which shows more activity in the market.

In short, the tight liquidity and the U.S. data have put ETH under pressure, and its price is showing signs of more drops.

Also Read: MicroStrategy Buys 2,530 Bitcoin, Now Holds 450,000 BTC