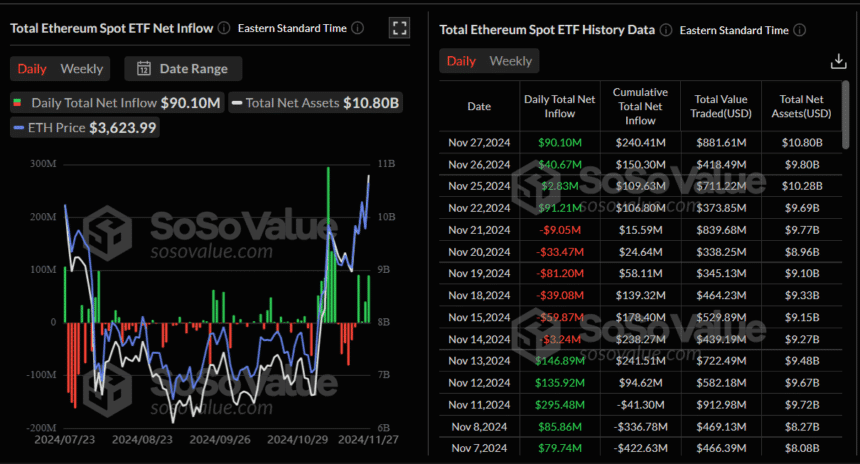

As of November 27, Ethereum (ETH) has achieved a significant milestone, with total net assets reaching an impressive milestone, with total net assets reaching an impressive $10.80 billion, marking 2.47% of the overall Ethereum market cap.

In just one week, the cryptocurrency saw a notable $133 million in net inflows, pushing the total cumulative inflows to $240.41 million.

As per the data by SoSoValue, the daily net inflow is also substantial, recording $90.10 million, reflecting growing investor confidence in ETH.

Spot Ethereum ETFs are gaining momentum, closely following in the footsteps of Bitcoin ETFs, as institutional interest continues to rise. Major players in the space have reported impressive inflows: BlackRock saw $1.85 billion, Grayscale added $416.76 million, Fidelity’s inflows totaled $745.09 million, Bitwise garnered $391.37 million, and VanEck attracted $115.75 million.

This surge in investment is largely driven by Ethereum’s price recovery, with ETH regaining its former highs and showing potential for further upside.

As of the latest data, ETH is trading at $3,609.19, marking a 3.71% increase in just one day. Over the past week, Ethereum has seen a strong rally, up 15.19%, outperforming Bitcoin in terms of price gains.

Market analysts are now eyeing the potential for Ethereum to break through the $4,000 barrier, a level that could signify a new phase of growth for the cryptocurrency. With ETH’s price momentum, strong ETF inflows, and growing institutional interest, the outlook for Ethereum looks increasingly bullish, positioning it as one of the most promising digital assets in the current market.

Also Read: Ethereum Name Service (ENS) Surges 39% Amid Altseason Buzz